Lack of working capital is a major issue for many UK businesses, with late payment of invoices being the primary culprit. This financial bottleneck can have detrimental effects on a business, impacting their ability to purchase stock, meet running costs and pay wages.

Without sufficient working capital, businesses can struggle to stay afloat and may even face failure. As a result, many businesses are forced to turn to finance to cover these gaps in cash flow, often facing high interest rates and unfavourable financing terms.

Traditional forms of borrowing

Traditional business loans have long been a staple source of funding for companies looking to expand their operations, invest in new projects, or manage cash flow. However, they can involve stringent qualification requirements, may require a charge over specific assets of the business as collateral, and potentially higher interest rates depending on market conditions.

Bridging loans serve as short-term financing solutions designed to “bridge” a gap between the immediate need for funds and a future inflow of capital. Bridging loans offer flexibility and speed, but typically come with higher interest rates and fees due to the short-term nature and perceived higher risk involved. The limitations of both traditional and bridging loans had led the rise of alternative forms of financing.

Challenges of Supply Chain Finance and Factoring

While supply chain finance (SCF) has been seen by some as a viable alternative route to traditional bank loans, it can also put strain on the relationship between suppliers and their customers. This can lead to suppliers being locked into unfavourable financing terms.

The associated high fees and interest rates can erode profitability, particularly when interest rates are sitting at decade-long highs. SCF can also limit their bargaining power and ability to negotiate fair prices with buyers. Factoring invoices with third parties also introduces additional risks and fees, further complicating the financial landscape for businesses.

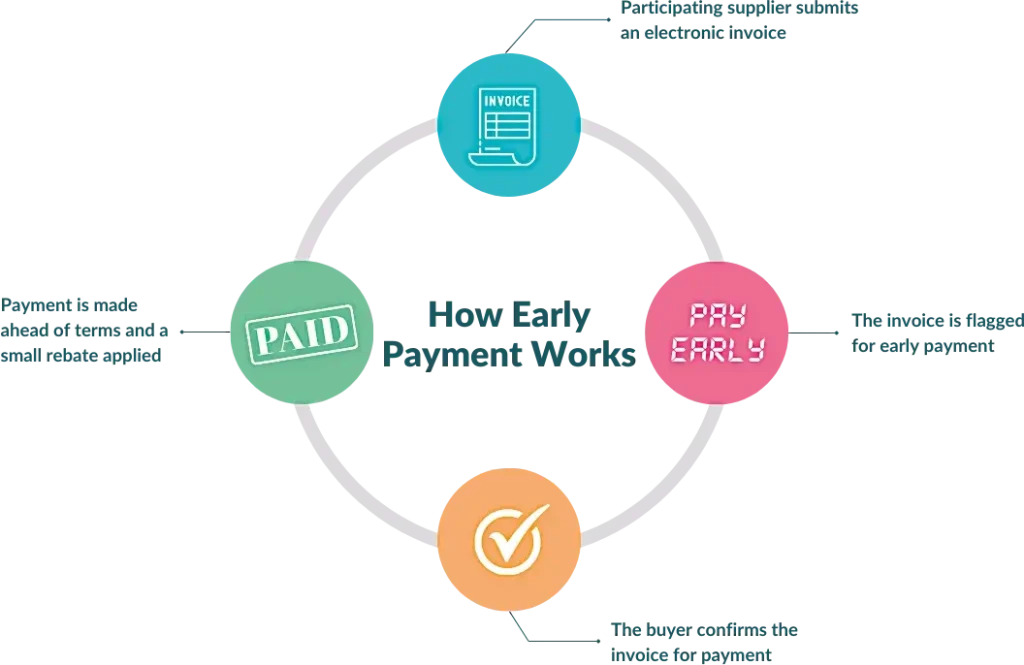

A Better Solution with Early Payment

Early payment offers suppliers the unique opportunity to receive accelerated payment from their buyers without the need for factoring, borrowing, or credit checks. Oxygen Finance, the UK’s leader in early payment solutions, works predominantly with local authorities to help them pay suppliers early in exchange for a small rebate.

This approach represents a compelling alternative to traditional solutions. It benefits both suppliers and buyers, providing improved cash flow for suppliers and creating additional savings for the organisations ready to be invested into protecting frontline public services.

Benefits of Early Payment

- Suppliers benefit from improved cash flow and can avoid financing altogether.

- Public sector organisations can use the new income stream generated to support local public services.

- By strengthening their suppliers’ cashflow, public sector buyers can keep the money flowing smoothly in their critical public sector supply chains. Indeed, some may elect to pay local small-and-micro firms early for free.

- Fairness and choice come as standard, with rebates only applied dynamically on payment, proportionate to the number of days payment is accelerated by.

- The new electronic invoicing and enhanced purchase-to-pay practices from early payment programmes act as a rising tide, benefiting all involved parties.

Strengthening Relationships and Generating Savings

Early payment solidifies and strengthens the relationship between buyers and suppliers, offering a way for public sector organisations to support their supplier base, deliver responsible payment practices, and generate savings that can be reinvested into public services. This approach aligns with Environmental, Social, and Governance (ESG) principles and appeals to both the supply chain, leadership, and citizens.

In a world where true win-wins are hard to come by, early payment solutions emerge as a transformative strategy for public sector organisations, fostering fiscal resilience and advancing the collective interests of all stakeholders.