The 2020/21 Financial Year saw total public sector spend increase by around 12% to over £288Bn. Although the first quarter of 2021/22 has seen growth in many categories cool due to an element of “calming-down” following the worst of the pandemic, there are still a number of categories in which investment has taken place. Below, we use Oxygen’s market-leading Illuminator system to take a closer look at which categories have seen the most growth in the early part of the current financial year, and some of the suppliers who have benefitted, by comparing Q1 spend with the same time last year:

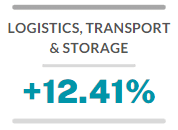

Highways & Transport Services

2020/21 saw a significant increase in spend in this category, however the emerging picture for 2021/22 is that this could be set to rise even further. Market leader Uniserve LTD’s public sector earnings for Q1 were over twice what they were at the same point last year, whilst Kuehne + Nagel LTD looks set to significantly increase its market share.

This category looks set to be led by a newcomer in 2021/22, with Milestone Infrastructure Ltd – formed following M Group Services’ acquisition of Skanska UK’s infrastructure services operation – earning over £20M from the public sector in this category during Q1.

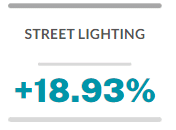

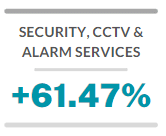

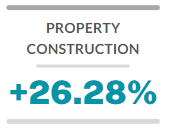

Buildings Services

This category looks set to see a significant increase in spend in 2021/22. Mitie Group looks set to further consolidate its 2020/21 position as the leader of this market, whilst G4S has also enjoyed a strong start to 2021/22, with its Q1 earnings in this category being around three times higher than last year.

After ranking third in the public sector spend standings for this category in 2020/21, Balfour Beatty has led the way in the early part of 2021/22, with Q1 earnings almost £100M higher than last year. Early indications are that the relatively established market-leading group of contractors could have a new member in 2021/22, with ISG PLC’s Q1 public sector earnings in this market up by almost 145%.

Waste Services

2020/21 saw Veolia Group leading the way in this category and the current financial year looks set to present a similar picture, with the supplier’s Q1 earnings up by almost 6%. However, even greater early year growth was enjoyed by Viridor, which saw its Q1 earnings in this category increase by almost 28% when compared to the same time last year.

“In-house” local authority provision of waste services creates a significant market of its own in the supply of the required equipment and vehicles. It’s a market traditionally led Dennis Eagle Ltd and 2021/22 looks set to be no different, with the supplier’s Q1 public sector earnings in this category up by just under 44%.

ICT Services

Although ICT-related spend across local and central government fell during the early part of 2021/22 following previous investment necessitated by the pandemic, spend by the NHS has continued to rise. EPIC Bristol Ltd looks set to continue its strong 2020/21 and has led this NHS category in early 2021/22 alongside regular market leaders Cerner and Softcat, whilst System C Healthcare also enjoyed a strong Q1 with NHS earnings in this category up by almost 79%.

This category is another area where NHS investment has continued into the current financial year. Computacenter (UK) Ltd enjoyed a strong end to 2020/21 and has continued this into 2021/22, with Q1 earnings in this category up by over 2000% when compared to the same time last year.

Health & Social Care Services

While spend across many individual health and social care service categories fell during the early part of 2021/22, spend on Lab & Testing Services has continued on the steady climb it began at the end of Q1 last year. Randox Testing Services saw its public sector earnings rise from a six-figure sum in 2019/20 to nine figures in 2020/21 and looks set for a further increase this year.

Spend in this category also looks set to continue on the climb it started at the end of Q1 last year, with spend at the end of June 2021 having increased by almost £700M when compared to the same time in 2020. Many of the suppliers in this market have seen significant increases in their public sector earnings since the start of 2020/21, with leading supplier Hologic Ltd’s Q1 public sector earnings in this category having increased by over 10,000% since the same time last year.