After four years of consistent growth, how did total spend by NHS organisations fare in 2020/21?

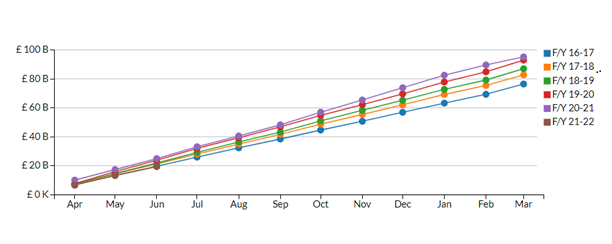

The 2020/21 Financial Year was heavily defined by the COVID-19 pandemic, which of course had a significant impact on the NHS. Oxygen’s Illuminator system – which provides the most comprehensive and up-to-date source of public sector spend data by aggregating and categorising the invoice data disclosed by well over 1000 organisations – is now able to highlight where NHS expenditure was concentrated during this period. In previous years, total NHS spending has consistently increased by an average of 5-8% year-on-year, however, Illuminator shows that 2020/21 saw this sustained level of growth reduce to 2.35%.

Below, we take a look at how total spending by NHS organisations fared in 2020/21 across some of the major markets:

Corporate:

Illuminator shows that total expenditure by NHS organisations on corporate services increased by 13.84%. This market, which has seen spend increase every year since 2015/16, is dominated by spend on recruitment and temp agencies and accounted for over 75% of all NHS spending on corporate services in 2020/21.

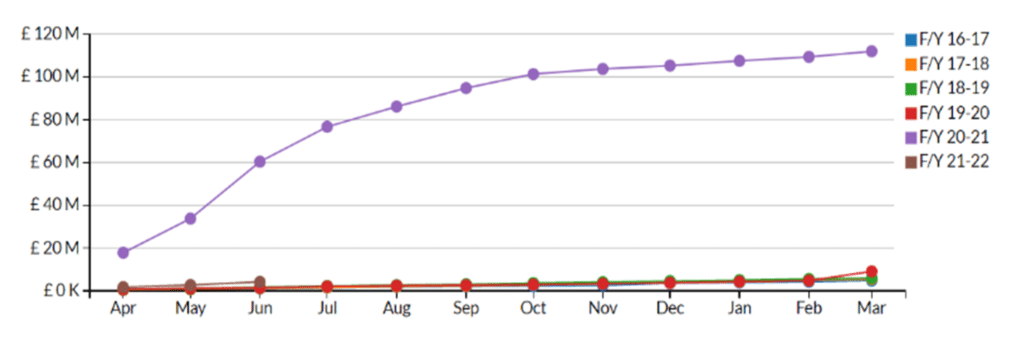

However, for specific categories, spending has increased at a significantly higher rate. For example, spending on Uniform, Clothing and Safety Equipment rose by 1130% as the graph below shows. To contextualise this, total spending rose by just over £110M, and this was most likely driven by the increase in demand for PPE procurement and safety clothing across the health service throughout the first waves of the pandemic, which attracted additional funding from the central government, as our previous blog from April 2020 illustrates.

Buildings:

NHS spending on buildings-related services rose by 11.98%. Within this, spending on property maintenance services went up £265.3M – an increase of almost 43% on the previous financial year. Total NHS spend across the market reached £8.4bn for 2020/21, and this made up 8.84% of spending across all the markets.

Health & Social Care:

For the Health and Social Care market, total NHS spending came to £75.35bn and this equates to 79.15% of spending across all the markets. However, this figure is £222M lower than the previous year with spending falling by 0.29% – the first time total spending has dropped since 2016/17. To understand why this is the case, Illuminator is also able to highlight that spending on Acute/Clinical services slowed to an increase of 2.76%, and spending across Patient Diagnostic and Imaging services decreased by 2.69% – a contrast to previous years where growth averaged 15-18% per year.

ICT & BPO:

Finally, within the ICT & Business Process Outsourcing (BPO) market, which made up 3.43% of total NHS England spend for 2020/21 (£3.27bn), spending rose by £680M – an increase of just over 26%. In particular, spending on Back Office Admin Services rose by its largest yearly margin, rising by nearly 24%.