Our latest Oxygen Insights report looks at the Local Gov ICT & BPO Power Players for 2024 and confirms some tight competition with Phoenix Software, Capita Group and Civica sharing the ranks in 2022-23 compared to the previous year.

The report delves into which areas of ICT have seen accelerated growth and the customers who are driving this success. We also look at the top ten players in local government Information and Communication Technology and Business Process Outsourcing. Curious to see what the data is saying? Let’s dive in.

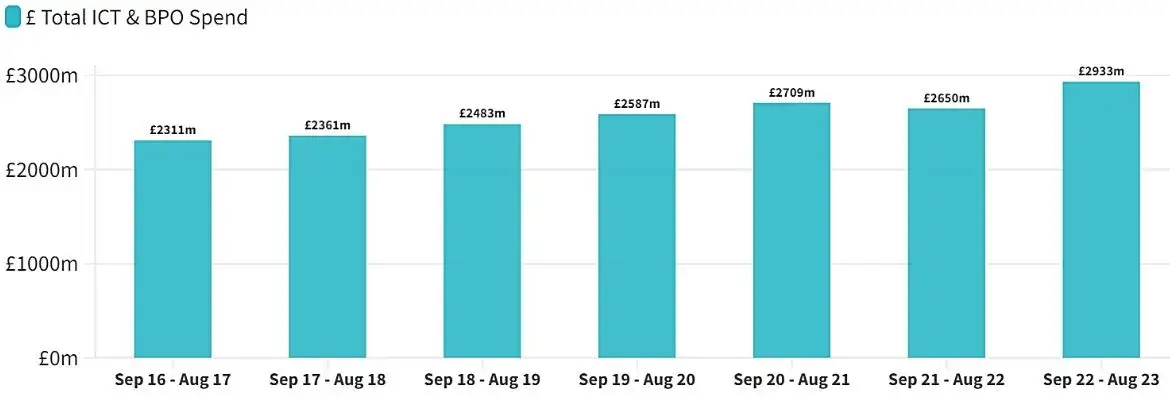

Local Gov ICT & BPO Spend Changes Post-COVID

Although total spending for local government ICT and BPO saw a decline post-COVID during Sept 2021-Aug 2022, spend on ICT and BPO has made noteworthy progress to top those previous levels, as hybrid working has increased the need for more ICT and BPO support and document management. Our figures show that Phoenix Software was reported as the biggest winner and became the single biggest supplier in this market, supplying almost 60% of UK Local Authorities. The top three suppliers (Phoenix, Capita Group and Civica) now account for 14% of the market, and 26% of the year-on-year growth.

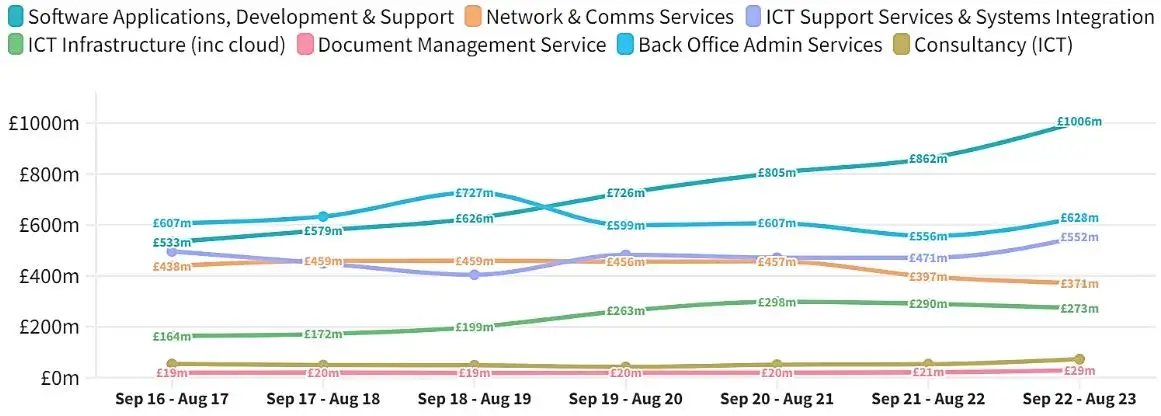

Trending ICT & BPO Categories

The biggest ICT category to double in spend is Software Applications, Development & Support with Phoenix Software supplying nearly 60% of UK Local Authorities and leading the charge with 16% of spend in this category. The data indicates that ICT Support Services & Systems Integration is also continuing to see an uptick in growth, whilst Network & Comms Services has experienced a downward trend, including BT suffering a two-thirds fall in local government revenues over the last five years. The report shows us that a transition to hybrid working in local government has boosted ICT spend with the clear winner being document management, reporting a +39.9% increase in expenditure versus the previous year. However, most categories have gained double-digit growth over the last year and continue to increase.

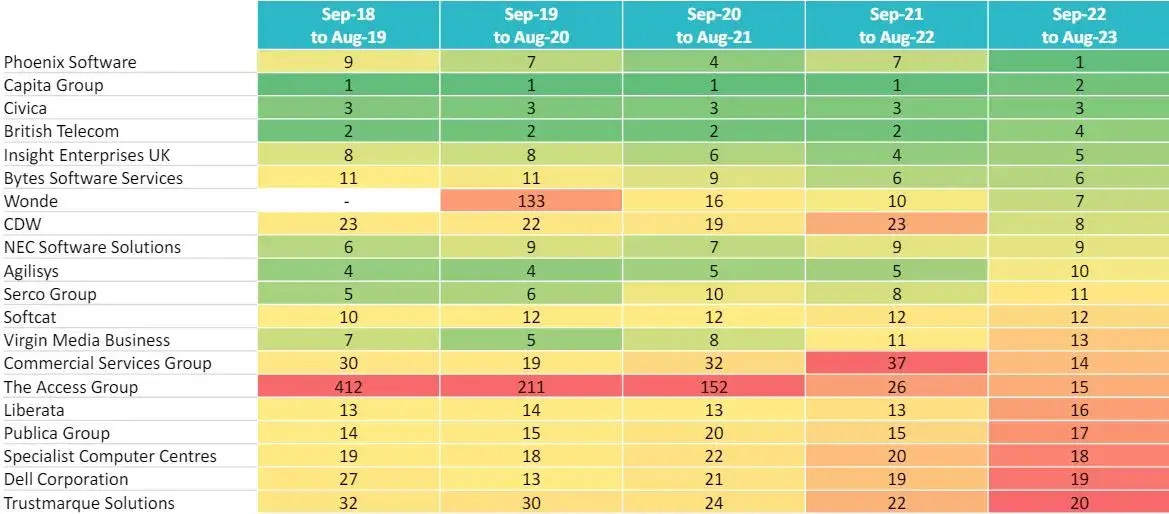

The Top Local Government ICT & BPO Suppliers

The top ten spots have seen a drastic change from just four years prior, although Capita Group and Civica continue to be in the top rankings, coming out at second and third respectively for the 12-months Sep 22-Aug 23. The supplier with the most impressive change is The Access Group, who have surged to 15th place from 412 in a five-year fiscal period. The report also includes the fastest-growing suppliers to earn over £10m within local government including Wonde and CDW, with £73m and £71m respectively. Big ICT players round out the rest of the rankings, including Phoenix Software, BT, Virgin Media, NEC Software Solutions and Softcat Plc.

Power Players Snapshot for the period Sept 22-Aug 23

1. Phoenix Software

Phoenix Software, part of the Bytes Technology Group Plc, is now the leading ICT and BPO supplier thanks to £66.3m spent by Lincolnshire County Council. The company’s overall public sector earnings from Sept-22 to Aug-23 amounted to £412m with a published turnover of £513m.

2. Capita Group

Capita Group has a substantial turnover of £3bn and continues to attract significant spend from local government with 244 buying authorities as customers, 16 of which spent over £1m. The largest two categories of spend with the company are Back Office Admin Services and ICT Support Services & System Integration.

3. Civica

Civica is contracted by over 5,000 public sector bodies internationally, and around two thirds of their UK public sector revenues (with a 5.91% three-year CAGR) come from local government, with the UK public sector accounting for around half of their £313m overall turnover.

4. British Telecom

British Telecom continued to work with 277 local authorities over the past 12 months, with most revenue coming from the Network and Comms Services category. Data from Oxygen Insights reports BT received over £455m in spend during the period Apr 22-Mar 23.

5. Insights Enterprises UK

Insight Enterprises UK is a solutions integrator and technology partner serving 289 local authorities, councils, and housing associations. The firm has a specific focus on Adult Social Care and Assisted Living, as well as the delivery of smarter spaces through IOT Connected Platforms.

6. Bytes Software Services

Bytes Software Services has a range of solutions including cloud, security, licensing, SAM, storage, virtualisation, and managed services. Part of the Bytes Technology Group Plc, its last disclosed turnover was £905m with the public sector accounting for £401m.

7. Wonde

Wonde is a previous Deloitte Technology Fast 50 UK winner, and the uptake of Wonde’s data permission control solution has led to the firm working with 65 councils and local authorities last year delivering £73m in revenues.

8. CDW

CDW’s last financial results revealed a turnover of £1.3bn with an impressive 10.11% 3-year CAGR. Overall public sector earnings amounted to £244m, with local government responsible for a quarter of that take.

9. NEC Software Solutions

NEC Software Solutions saw £57m of their £99m UK public sector earnings over the last year accounted for by local government. NEC’s largest categories of spend are Software Applications, Development & Support, ICT Support Services & Systems Integration and Back Office Admin Services.

10. Agilisys

Agilisys stated an overall turnover of £101m in the last fiscal year, a slight three-year CAGR decrease of -1.38%. Earnings from the public sector amounted to £68m, of which £54m, or around 80%, came from local government. ICT Support Services & Systems Integration and Back Office Admin Services account for the lion’s share of their earnings.

That’s just the top ten, but there’s always more data! If you like what you see, please check out our full ICT & BPO Local Gov Power Players report for even more information, including top suppliers, buyers and spend data.